DECEMBER 2024

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Loan Limits, Rates, and Market Insights

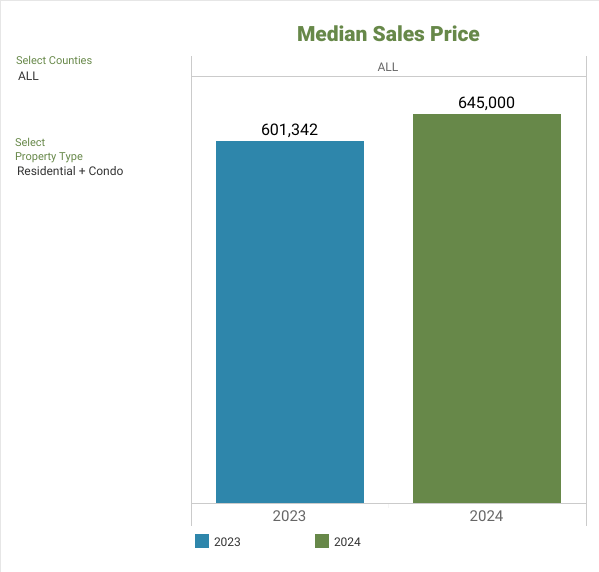

As November comes to a close and the holiday season begins, the real estate market is seeing significant developments. Key metrics from November reveal new loan limits for 2025 that are set to impact many buyers. The focus remains on residential properties, excluding condos, multifamily units, and vacant land. Notably, the conforming mortgage balance has increased to $806,000 from $742,000, and the new high balance for single-family homes in certain counties is now $1,037,000. These adjustments are particularly important for those close to needing jumbo loans.

Mortgage rates have remained steady to slightly higher since October, with a notable dip following a half-percent rate cut by the Federal Reserve. It's crucial to understand that the Fed controls short-term rates, such as those for HELOCs and car loans, while long-term mortgage rates are influenced by the bond market. Looking ahead, rates are expected to stay in the high sixes to low sevens through 2025. This forecast includes potential aggressive market activity driven by the new administration's policies, with an emphasis on reducing government waste to avoid budget shortfalls.

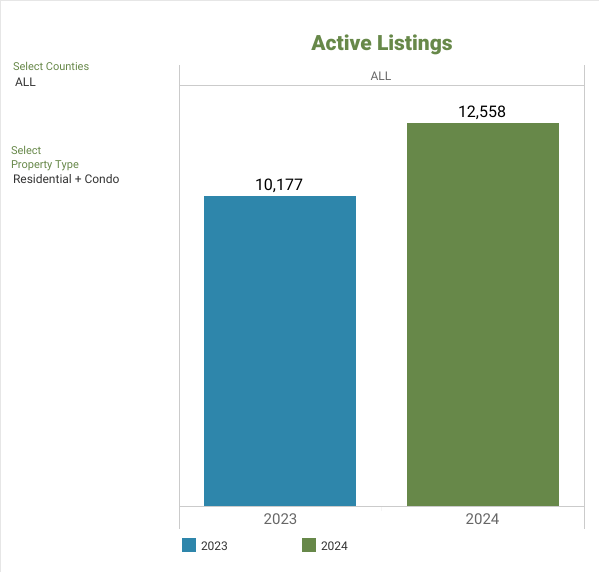

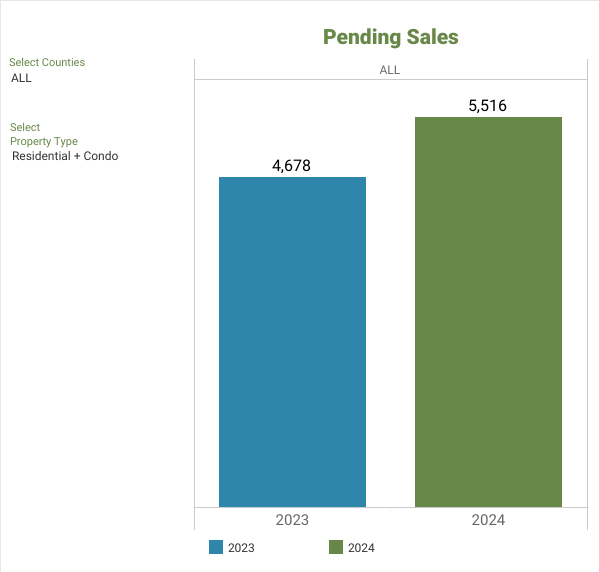

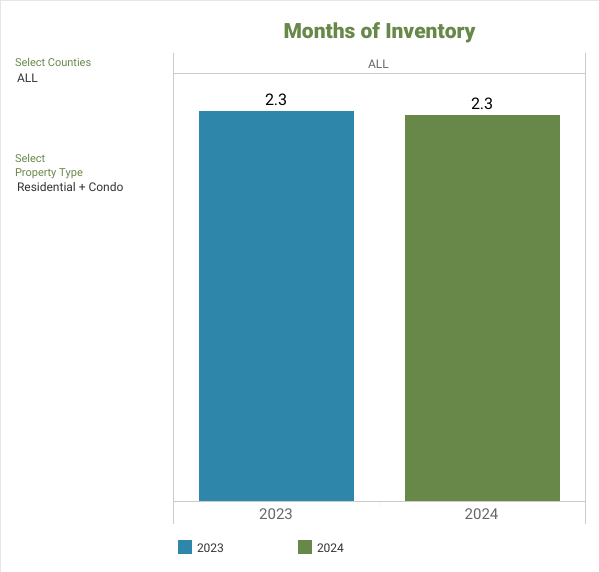

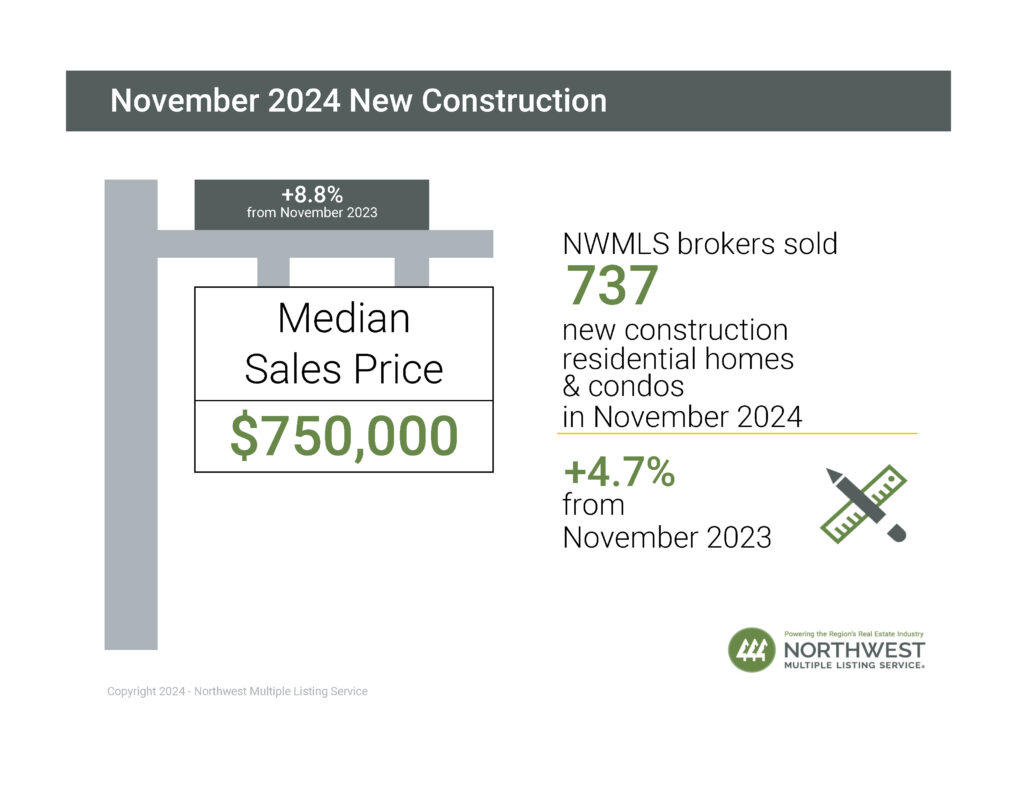

In the current real estate market, average market times and list-to-sales price ratios are typical for November. As rates continue to drop, more buyers are likely to enter the market, especially with good inventory available. New construction is offering attractive incentives like lower interest rates and upgrades, making it an excellent time for buyers. While there are few foreclosures, bank-owned properties often have longer market times due to initial overpricing.

As November comes to a close and the holiday season begins, the real estate market is seeing significant developments. Key metrics from November reveal new loan limits for 2025 that are set to impact many buyers. The focus remains on residential properties, excluding condos, multifamily units, and vacant land. Notably, the conforming mortgage balance has increased to $806,000 from $742,000, and the new high balance for single-family homes in certain counties is now $1,037,000. These adjustments are particularly important for those close to needing jumbo loans.

Mortgage rates have remained steady to slightly higher since October, with a notable dip following a half-percent rate cut by the Federal Reserve. It's crucial to understand that the Fed controls short-term rates, such as those for HELOCs and car loans, while long-term mortgage rates are influenced by the bond market. Looking ahead, rates are expected to stay in the high sixes to low sevens through 2025. This forecast includes potential aggressive market activity driven by the new administration's policies, with an emphasis on reducing government waste to avoid budget shortfalls.

In the current real estate market, average market times and list-to-sales price ratios are typical for November. As rates continue to drop, more buyers are likely to enter the market, especially with good inventory available. New construction is offering attractive incentives like lower interest rates and upgrades, making it an excellent time for buyers. While there are few foreclosures, bank-owned properties often have longer market times due to initial overpricing.

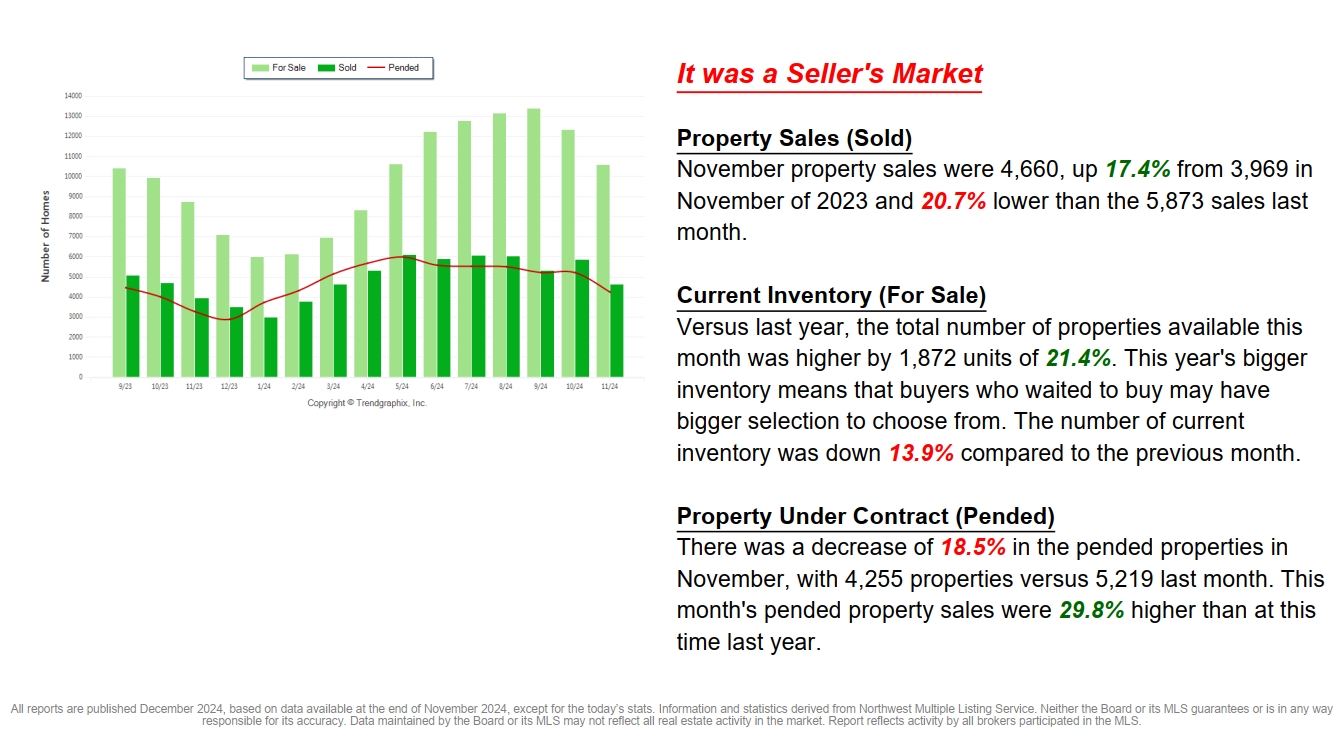

NWMLS Market Snapshot - NOVEMBER 2024

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates